Why choose Nodhom ERP Apps?

Nodhom complies with the ZATCA’s requirements to implement the first and second phases of the e- invoice

Phase 1

December 4th, 2021

Generate and store tax invoices and notes through electronic solutions.

Phase 2

January 1st, 2023

Integration of electronic solutions with ZATCA’s systems.

Requirements for the first phase of the electronic invoice ( Generation Phase )

Stop issuing manual/hand-written invoices

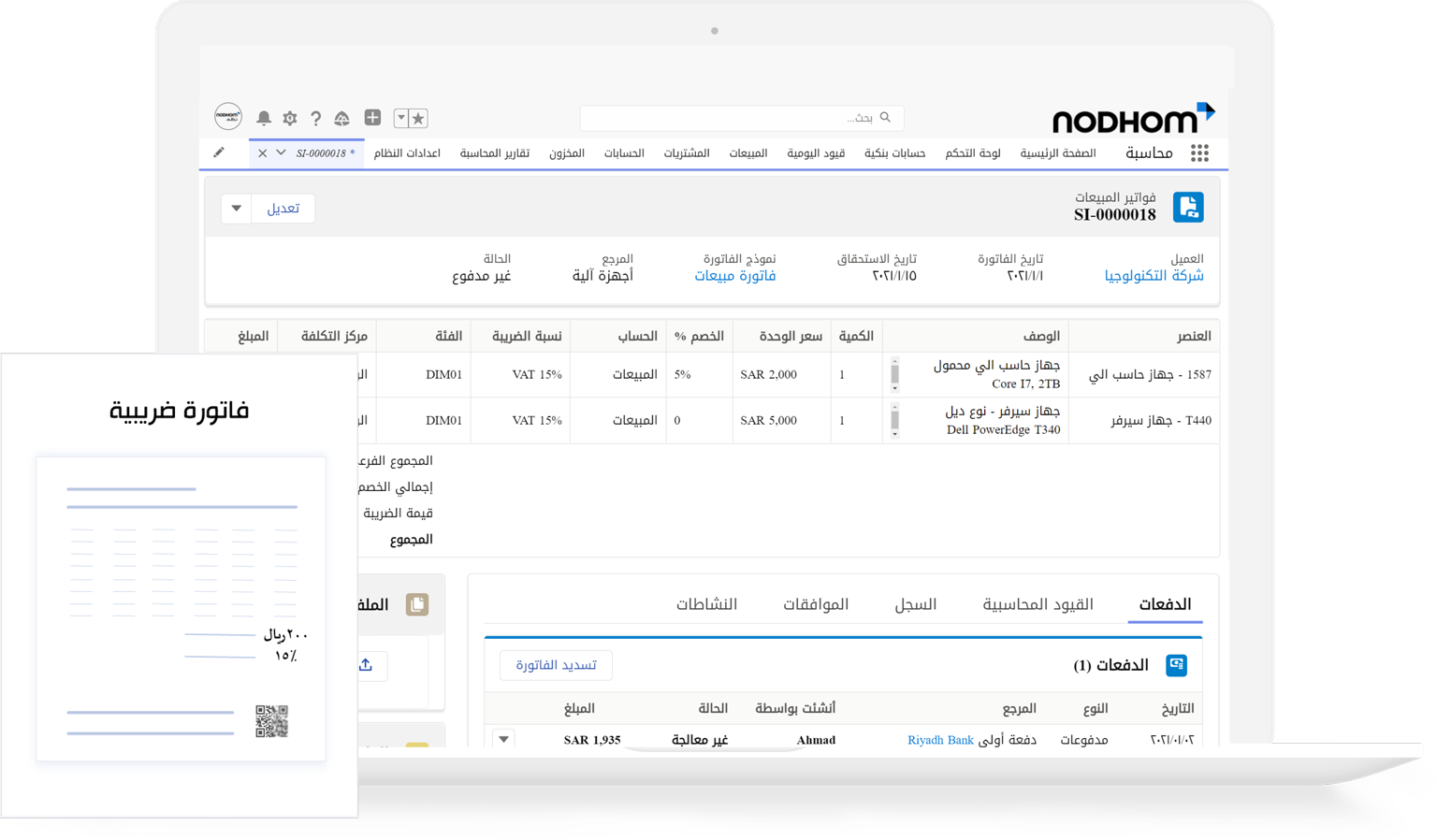

Use a compliant electronic invoicing solution

Ensure all elements of tax invoice are fulfilled

Comply with the requirements of the second phase of the electronic invoice ( integration phase )

Ensure e-invoicing solution has the ability to connect to the internet

Ensure all phase two required additional fields are fulfilled

Integrate the e-invoicing solution with 'Fatoora' portal

Generate and store e-invoices in the approved format

Nodhom ERP Apps Complies with The ZATCA's Requirements

Nodhom provides the complaint electronic solutions

Cloud-based system that allow access all your data via the internet

Complies with the requirements of Cybersecurity in KSA

Detecting tampering or editing performed on invoices

Allow integrating with external systems (API)

FAQ

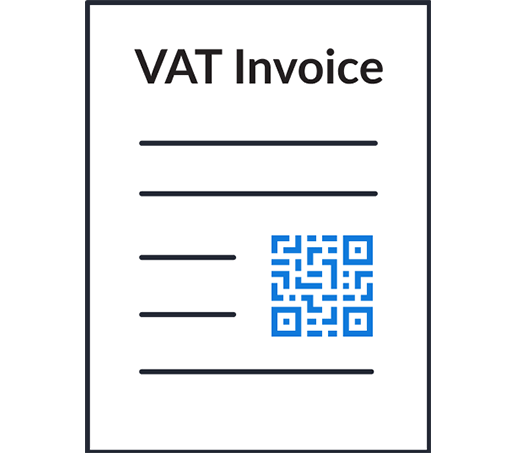

What is E-Invoicing (FATOORAH)?

A tax invoice that is generated in a structured electronic format through electronic means. A paper invoice that is converted into an electronic format through copying, scanning, or any other method is not considered an electronic invoice.